Decision Making Process in Banking Sector

To improve its decision-making company executives implemented the concept of RAPID. Data driven decision making in the banking industry.

Data Driven Decision Making In Business Process And Model Data Driven Data Competitive Intelligence

Data-driven decision-making process can be easier in the building services sector.

. This study applies models of ethical decision-making to investigate the reasons why customers choose conventional rather than ethical banks and vice versa. As more decision-making authority has been delegated to the central bank group decision-making has become more common. Sophisticated analytical tools are available to you to see a wider range of possibilities and evaluate them quickly.

This has been driven by recent rapid advances in data analytics and. When organizations get big sometimes positions can get blurred. Heuristics are used in the judgment and decision-making process of bank employees.

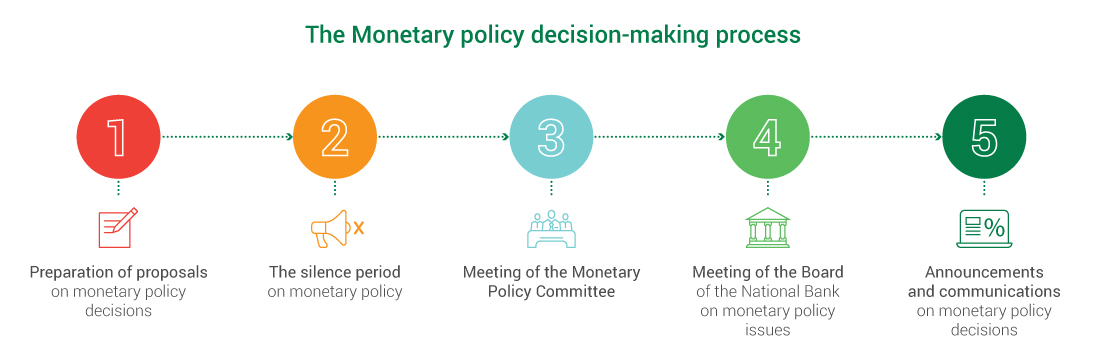

By Neil Shah Head of Financial Services Board The move towards strategic decision-making Now with the pandemic restrictions lifting banks will have to be strategic in their decision-making when it comes to recuperating any lost income and balancing consumer trust with a focus on growth. The major participants in the decision-making process are the Governing Council the Monetary Policy Review Committee MPRC and the four economics departments at the Bank. More data are within your reach to understand what was previously unknown.

Bank employees can readily access information and share it with key stakeholders. The use of DSSs has been received with great zeal in the e-banking industry especially in the decision making process. Firstly a model of bank customers ethical decision-making.

Data-driven decision-making or DDDM for short is an organizational process that businesses use to inform or validate business decisions or strategies. However discussions and research on the type or range of judgmental heuristics are very difficult to find throughout the world. Combination of MIS Systems in Management Decision Processes in Banking.

2 days agoNo individual making more than 125000 or household making more than 250000 the top 5 of incomes in the United States will receive relief. The decision-making ability in any sector including banking is not limited to just risk management. That was the case here.

Start with non-standard work. Decision trees in the banking sector have been long known in the fields of risk management or risk analysis. But it is certainly not new.

Aiding organizations in making informed decisions is an important function of case management in banking. Decision trees can aid all parts of customer service in banking. Companies that have well-established data-driven decision-making processes are known as data mature and can easily draw on available data to make strategic decisions about their businesses.

The banks marketing operation lacked standard guidelines for roles and responsibilities. Data has been present since ages from stone tablets on which people recorded harvest data and kings names on temple inscriptions to the. Various components required to run such systems include hardware and software networks data management techniques and converters of the info into useful information.

Although the banking industry is increasingly focused on the issue of sustainability the market share held by ethical banks remains small. The current banking industry s apply an idea of the web banking system thats computer-based. Group decision-making is thought to lead to better more accurate decisions an idea that has both theoretical and empirical support.

Ad Browse Discover Thousands of Book Titles for Less. Process improvement ideas in banking Number 1. Big Data has been touted as the next big thing.

Poor decision making in the banking industry can be costly in terms of lost revenue as well as reputational damage. Data driven decision making in the banking industryNovember 28 2017. Professionals are busy with ongoing project work which makes it difficult to arrange time for personal.

AAU augmented automated underwriting is an example of the realisation of AIs promise. The rapid change in technology use and required skills for professionals in the field of building services makes continuous learning an essential requirement. It consequently makes advanced complex and precise decision-making available to a broader range of underwriting businesses which is good for those businesses good for customers and ultimately good for the entire industry.

The companys situation was. Therefore from the literature that has been evaluated it is clear that the research shall act as an efficient tool of. The use of DSS in the e-banking sector has led to speedy and efficiency in the decision making process.

They are enablers of compact decision-making in any situation. The State Of Decision-Making research found that while a clear majority of respondents 63 working within the banking and finance sector say the important decisions they are responsible for get implemented globally the decision-making process itself is not joined-up across the business with one third 33 also saying that crucial. A lack of a clear decision-making process meant inconsistent ad hoc decisions in local operations around the globe It was a classic case of global versus local in terms of decision-making.

By group decision-making especially in relation to monetary policy Table 7. Now is a good time for an upgrade in your decision making. There were no submission or intake templates for each gate in the marketing process.

In light of this the purpose of this paper is to empirically analyze what types of heuristics are used in bank employees judgment and decision-making. Enhanced credit and risk decision making process re-engineering and customer management and marketing. Help borrowers of all ages.

And decision making as usual may not be right for the task. The return of the workforce will of course coincide with. The Governing Council which is responsible for making each interest rate decision consists of the Governor the Senior Deputy Governor and four Deputy Governors.

Our Retail Banking Practice recently launched a brochure to assist our clients determine their approach to upgrading their decision making within three key focus areas.

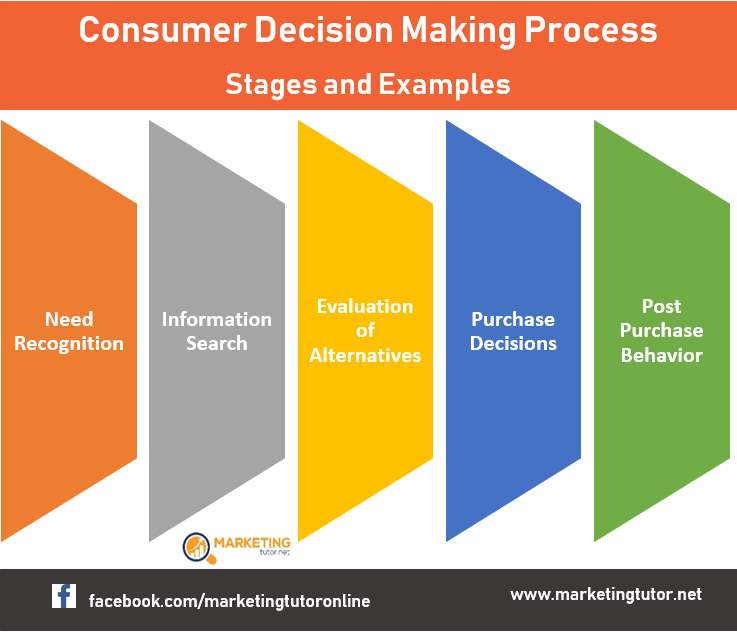

Understanding The Consumers Decision Making Process In Sales

Relation Between Planning And Decision Making

Consumer Decision Making Process Definition Stages And Examples

Comments

Post a Comment